It’s surprisingly difficult to crack the numbers when trying to plan for the long term, and it’s not for the lack of information, but it’s simply because one has to make some assumptions, and, yet, those assumptions have to be accounted for in the calculations. With all the investment calculators available out there, a lot of them are lacking the functionality to capture those assumptions.

So let me share yet another one, which is actually a google spreadsheet:

https://docs.google.com/spreadsheets/d/1OjFIHxUAZClqLR2REVsI-8yUBEHC6wWL8V5HrMvOCK8/edit?usp=sharing

In order to use it, first make a copy – otherwise, you won’t be able to make any changes. Once you have a copy, consider adjusting the “settings” as you see fit:

- Investment – that’s your starting principal

- Year 1 Target – your withdrawal in the first year. Subsequent withdrawals will be adjusted to inflaction, but, other than that, they’ll match year 1

- Inflation – average inflation rate, I used 3.8% for Canada

- Average Tax Rate – this is your average tax rate which will be applied to the withdrawals

- Positive Rate Worst – the worst expected positive return rate (would be a fixed value for GIC-s, otherwise set a value at or above zero)

- Positive Rate Best – the best expected positive return rate (would be a fixed value for GIC-s, otherwise set a value at or above zero)

- Negative Rate Worst – the worst expected negative return rate (would be 0 for GIC-s, otherwise set a value at or below zero)

- Negative Rate Best – the best expected negative return rate (would be 0 for GIC-s, otherwise set a value at or below zero)

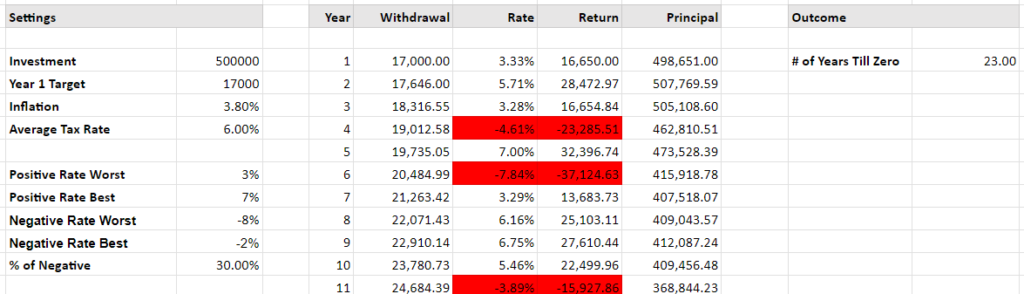

- % of Negative Adjustments – you can choose a different number, but I assumed that the market will perform worse 30% of the times

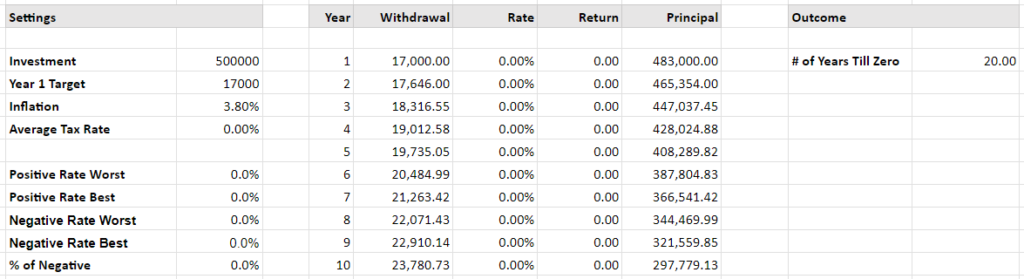

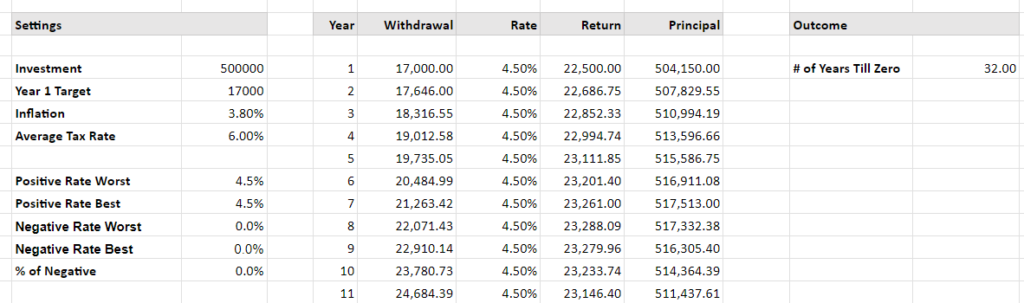

With all that in mind, you will quickly realize that a 500K initial investment will only last for about 20-30 years if you choose to keep withdrawing 17K from it every year in today’s money:

You could try adjusting the settings to make it look more like a bond portfolio (smaller returns, higher taxes, no positive/negative adjustments), and your principal amount will be depleted in about 32 years:

Which is, actually, pretty interesting. Market conditions have to be quite favorable for a stock portfolio (my first example) to overtake a bond/GIC portfolio; otherwise bonds seem to work better. That’s if you can get your bond/gic portfolio to return at least 4.5% per year.

In either case even 32 years is not a guarantee given the life expectancy of 80-85 years. If you are a bit lucky, you might end up outliving your investment, which is not great.

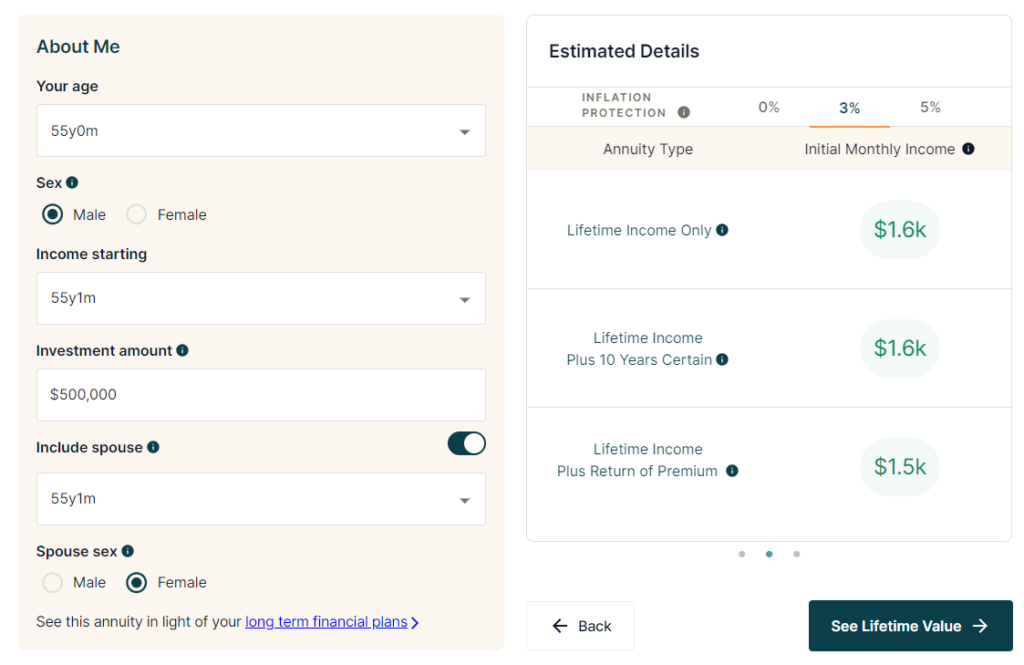

Of course there is another option, which is to go with an annuity:

As you can see on the screenshot, you’ll get about the same yearly payment (once you add a bit higher inflation rate and adjust for taxes), and, besides, you are all but guaranteed not to keep any of your principal amount. But, then, if you live beyond that 80-85 threshold, the annuity will keep paying you.

Well, go figure what’s best. One thing is certain – if you don’t invest at all, your initial deposit will only last for 20 years assuming the same inflation-adjusted yearly withdrawal amount: