There are different types of investments out there in Canada, but, it seems, the most important ones are bonds, gic-s, and stocks. How are they actually different? Here is a small comparison table:

Bonds

- They offer guaranteed coupon payments

- You get principal value returned to you at maturity

- Bonds are similar to stocks in that you can trade them. The prices may fluctuate, though they normally do it on a smaller scale. This also makes them different from GIC-s, since, with the GIC-s, your money are locked

- From the tax perspective, you may have capital gains (or losses) at maturity or when you sell (only 50% is taxed), and you will also have interest income (which is 100% taxable)

GIC-s

- They offer guaranteed interest payments

- The original value is returned to you at maturity

- You cannot trade GIC-s, though you may be able to cash or redeem if that particular GIC allows

- From the tax perspective, GIC-s income is 100% taxable

Stocks

- The payments are not guaranteed

- With the stocks, you may have capital gains (or losses), and you may also have dividend payments. From the tax perspective, gains are taxable at 50%, dividend payments are taxable at 100%, but, depending on the type of dividends, you may be eligible for a dividend tax credit. Keep in mind that dividend tax credit also assumes that your dividend income will be grossed up for the tax purposes. This all only happens for the dividends received from the Canadian corporations – foreign dividend income is not subject to the gross-up / tax credit rules

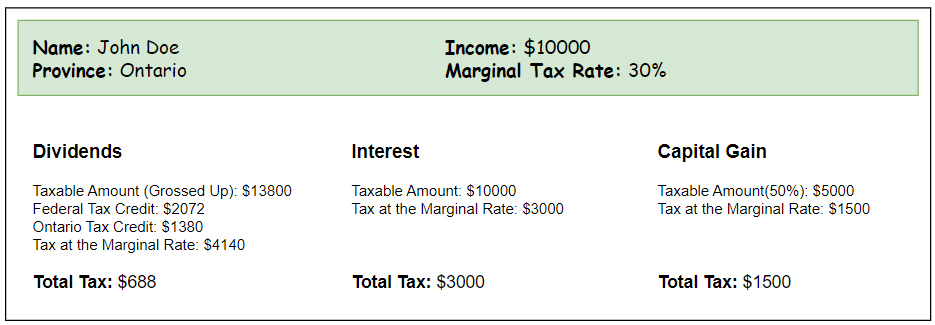

This is all good, but how does the choice of investment instrument affect your tax? We are talking about 3 types of income:

- Dividends

- Interest

- Capital Gains

Assuming none of that income is tax-free (so, it’s not a tax free savings account, and it’s not an RRSP), here is what happens:

Because of the dividend tax credit, Dividends income ends up being taxed at the lowest cumulative rate, whereas Capital Gains comes next, and Interest income gets the worst possible treatment.

However, even though “Interest” income stays in the last place from the tax efficiency perspective as your marginal tax rate grows, at some point capital gains may become more efficient than dividends. For Ontario, for example, that happens once your income (before dividends/gains) gets to around $97K per year.